When it involves company entities, Limited Liability Companies (LLCs) are a preferred choice amongst entrepreneurs due to their adaptable framework and safety attributes. An LLC is a company structure in the United States wherein the owners are not directly responsible for the business's debts or responsibilities. This is a considerable benefit as it limits the danger to individual assets while enabling service operations to proceed under a different legal entity. Structurally, an LLC can be managed by its participants, who are the owners, or by supervisors, that makes it adaptable to various organization circumstances. The selection of monitoring can influence how the LLC is perceived by financial institutions and various other financial establishments, possibly influencing financing possibilities.

Past responsibility defense, LLCs use tax benefits. Unlike firms, LLCs are normally dealt with as pass-through entities for tax obligation objectives, indicating that earnings is strained at the participant degree, not at the company degree. how to look up a corporation in california avoids the dual taxes often come across in firms. Developing an LLC can be a reasonably uncomplicated process with marginal documentation, depending on the state in which it is established. Each state has its very own laws and costs associated to the formation and operation of LLCs, so it's critical for potential LLC participants to understand their details state demands. Furthermore, LLCs provide a high degree of adaptability in profit sharing amongst participants, as it does not need to associate with ownership percentages, providing special possibilities for structuring investment and revenue distribution.

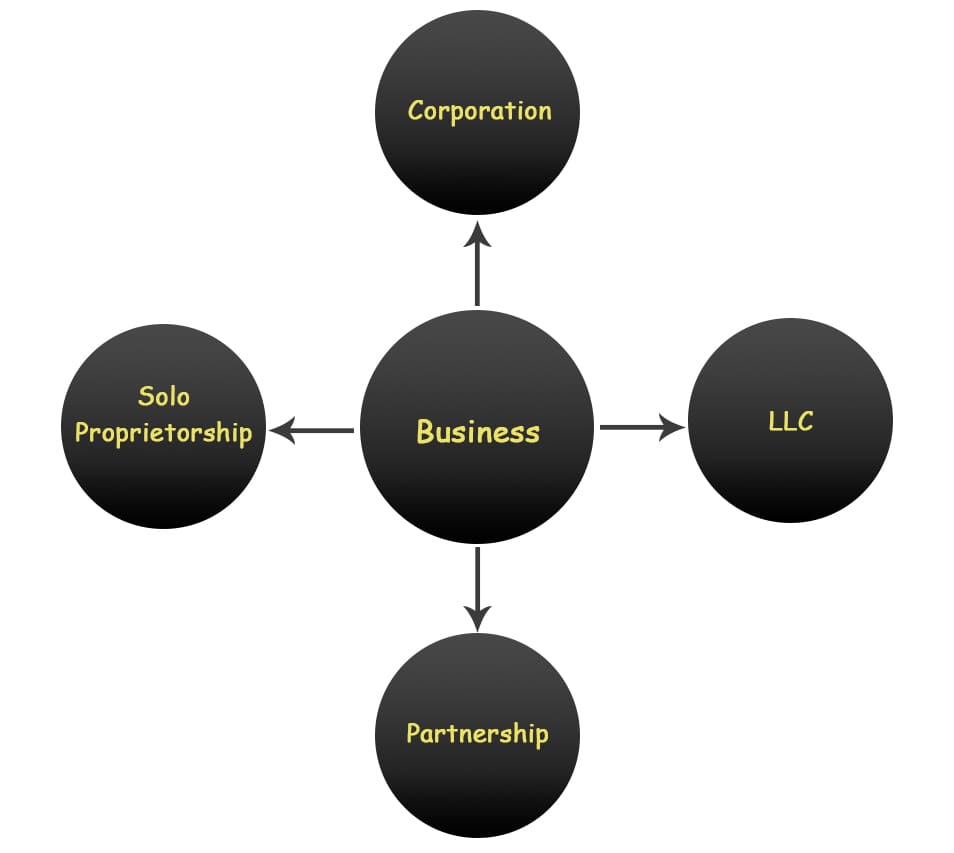

Understanding the Framework and Benefits of an LLC

Minimal Liability Companies (LLCs) are a preferred company framework in the USA, recognized for their flexibility and protective functions for owners. An LLC combines components of both collaboration and business frameworks, supplying a special mix of adaptability with less formalities compared to a corporation. Proprietors of an LLC, called members, can profit from the protection against individual obligation, meaning individual possessions are usually secured from company financial debts and insurance claims. This makes an LLC an attractive choice for little to medium-sized entrepreneur who are worried concerning individual monetary exposure. Additionally, LLCs are recognized for their tax benefits. Unlike a company, an LLC has a pass-through tax system. This implies that the company itself is not taxed straight. Rather, the profits and losses of the organization "pass via" to the members, that then report this information on their personal tax returns. As a result, this can avoid the issue of dual taxation, which typically takes place in firms where both the earnings and the rewards paid to shareholders are taxed. Furthermore, LLCs offer considerable flexibility in management. Unlike companies, which are required to have a board of supervisors and hold regular conferences, LLCs can be managed by the members or by supervisors they assign. This can be particularly beneficial for smaller sized companies that may not have the resources to deal with the intricacies of corporate administration. The operational adaptability prolongs to membership as well; there is no cap on the variety of participants an LLC can have, and participants can include individuals, various other LLCs, or perhaps companies. Establishing an LLC additionally permits less complicated start-up and upkeep. The procedure involves declaring short articles of organization with the state and paying a declaring charge, which differs by state. The continuous maintenance needs, like yearly reports and fees, are typically easier than those needed for corporations. This ease of development and maintenance, along with the significant legal and tax obligation advantages, makes the LLC a favored option for several entrepreneurs aiming to begin a brand-new service or formalize an existing one.

Understanding the Framework and Benefits of LLCs

Minimal Responsibility Companies (LLCs) supply a appealing and flexible lawful structure for many business owners, integrating the tax obligation benefits of a collaboration with the obligation security of a corporation. This dual benefit makes LLCs a favored option for tiny to medium-sized business (SMEs). When developing an LLC, proprietors, who are described as members, can choose a single-member LLC or a multi-member LLC, depending upon the variety of individuals involved. Each state in the united state has its very own details regulations regulating the formation and procedure of LLCs, which can affect every little thing from the documents needed to the tax commitments. Among one of the most substantial benefits of an LLC is the security it uses to its participants from personal liability for service financial debts and claims. This suggests that when it comes to company failure or legal actions versus business, the personal assets of the participants, such as their homes, automobiles, and various other personal possessions, are generally safeguarded. An additional crucial attribute of LLCs is the adaptability in taxes. An LLC can elect to be tired as a single proprietorship, collaboration, or company, giving substantial versatility when it comes to monetary preparation and tax obligation filing. Functional flexibility is also a hallmark of the LLC structure. Unlike companies, which are needed to have a formal structure with directors and policemans, LLCs can run with much less rule. They do not require a board of supervisors, annual conferences, or complicated record-keeping procedures, that makes them simpler and less pricey to manage. Additionally, LLCs enable an endless variety of members, and there are no limitations on the kinds of individuals or entities that can be members, consisting of individuals, corporations, and also other LLCs. Regardless of these benefits, there are also some complexities and potential drawbacks to take into consideration when creating an LLC. Participants of an LLC are typically called for to pay self-employment tax obligations on their profits from the company, which can be higher than the tax obligations business employees pay. Additionally, due to the fact that the policies bordering LLCs can differ substantially from one state to another, it is critical for prospective participants to comprehend the particular regulations and requirements in their state. Consulting with legal and monetary experts can help to navigate these complexities, making certain that the LLC framework is optimized for both protection and success.

Trick Factors To Consider When Forming an LLC

Creating a Restricted Obligation Company (LLC) is a preferred selection for several business owners because of its adaptability and protective functions. An LLC distinctly incorporates the pass-through taxes of a partnership or sole proprietorship with the restricted responsibility of a corporation, making it an appealing structure for organizations of all sizes. When considering the establishment of an LLC, one must very carefully examine numerous important aspects. The selection of state for enrollment is important as each state has its very own policies, regulations, and fee structures. States like Delaware, Nevada, and Wyoming are preferred as a result of their business-friendly legislations, but regional considerations and the nature of your business may affect your decision in a different way. Second, the procedure of naming your LLC is not only a branding exercise however additionally a legal need. The name must be distinct and not too similar to existing entities in your picked state. It likewise typically needs to consist of "LLC" or "Limited Liability Business" in the title to adhere to state laws. After the name, composing and submitting the Articles of Organization with the state's service declaring office is another action. This document consists of crucial details concerning your LLC, such as its name, address, and the names of its members. In addition, developing an Operating Arrangement is very suggested although it's not required in all states. This interior record details the monitoring framework of the LLC and states the rights and duties of the participants. It can offer clarity and avoid problems among participants by describing procedures for taking care of modifications in subscription, allotment of losses and revenues, and various other operational procedures. Moreover, understanding and taking care of the tax obligation responsibilities for an LLC is essential. The default government tax obligation standing for LLCs treats them as pass-through entities, indicating that the LLC itself does not pay taxes on organization earnings. Instead, are state agencies corporations and earnings are travelled through to individual participants' income tax return. An LLC can also pick to be exhausted as a firm if that confirms more advantageous under certain situations. Lastly, compliance with ongoing legal and governing needs is essential to maintain excellent standing. This consists of declaring annual reports, renewing business licenses, and paying any kind of essential state and federal tax obligations. Neglecting these obligations can bring about fines, or worse, dissolution of the LLC. Each action in preserving an llc and developing carries its very own set of requirements and obstacles, making it essential to thoroughly research study and perhaps speak with economic and legal specialists to make sure conformity and make one of the most enlightened decisions feasible.

Recognizing the Financial and Tax Effects of an LLC

When developing a Limited Obligation Business (LLC), it is essential for entrepreneurs to realize the monetary and tax obligation effects related to this kind of organization framework. An LLC uniquely incorporates the pass-through tax of a partnership or single proprietorship with the minimal responsibility of a company, making it an attractive alternative for numerous company owner. However, understanding the subtleties of exactly how an LLC is exhausted is crucial for effective economic preparation and lawful conformity. Normally, an LLC is dealt with as a pass-through entity for tax obligation functions, meaning that the service itself does not pay tax obligations on its revenue. Rather, revenue is "gone through" to the LLC's members and reported on their personal tax obligation returns. Each participant then pays taxes according to their individual tax obligation brackets. This arrangement can stay clear of the dual taxation frequently related to corporations, where both the service and the shareholders are taxed. LLCs provide flexibility in terms of tax condition. An LLC can likewise choose to be taxed as an S-Corporation. This political election can be valuable in lowering self-employment taxes, as participants can be treated as workers and receive a wage along with profit circulations. It's essential to keep in mind, though, that while the S-Corp condition can provide savings on self-employment tax obligations, it additionally requires stricter compliance with income policies and payroll tax obligation demands. Additionally, the resolution of affordable wage versus distribution can be complicated and typically calls for advice from a tax obligation specialist. Economically, taking care of an LLC additionally entails understanding and taking care of different state-level charges and needs, which can differ widely depending on the state in which the LLC is signed up. These could consist of annual record fees, franchise business taxes, and public filing demands, all of which can impact the general monetary health of business. Correct accounting and monetary monitoring are critical, as they not only aid in keeping the company's financial stability but also in corroborating the separateness of business from its participants, which is vital to preserving limited obligation security.

what is an annual return for a company considering forming an LLC must seek advice from with both legal and financial professionals to fully comprehend the potential economic advantages and obligations. Doing so will help guarantee that business structure lines up with both their company objectives and individual monetary situation, ultimately aiding in the long-term success and security of their venture.